As the national government gradually eases quarantine restrictions, Yuchengco-led Rizal Commercial Banking Corporation (RCBC) and its mass-market super app DiskarTech has recently inked a collaboration with the Philippine Association of Stores and Carinderia Owners (PASCO) to further strengthen the bank’s support to micro-retailers in the country.

The partnership aims to on-board more than 2,000 PASCO members to the formal financial ecosystem using RCBC’s first Taglish and Cebuano financial inclusion super app DiskarTech via its Batch Enrollment Services (BES) program, which simplifies the account opening and verification process for micro, small and medium enterprises (mSMEs).

For PASCO, the collaboration with RCBC’s DiskarTech is an indication that micro-retailers are now prepared to embrace digitalization.

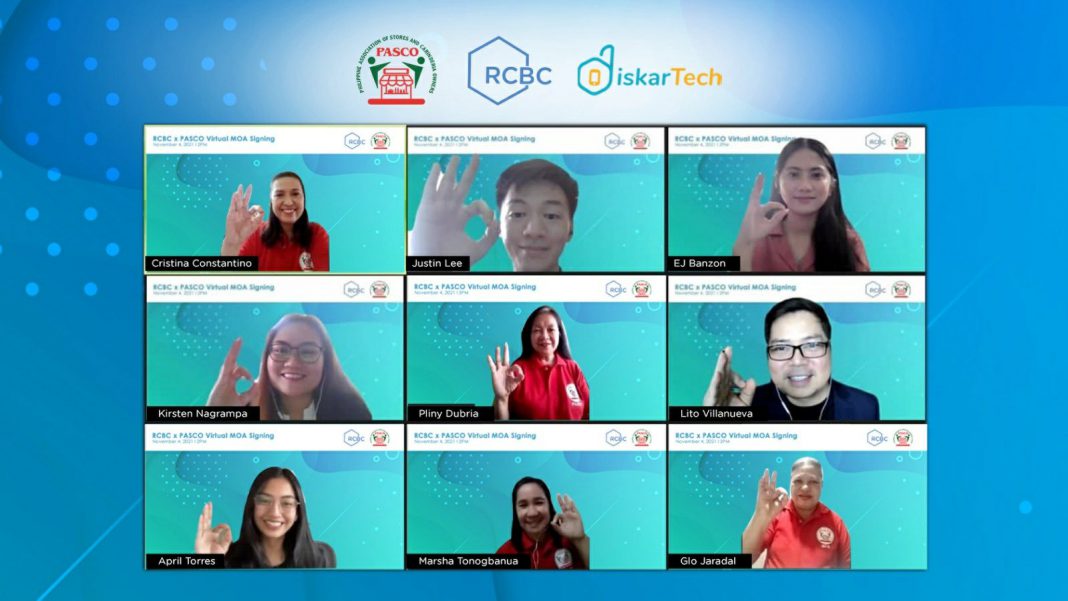

“Filipinos have long relied on micro-retailers for their daily basic needs. We in PASCO believe that the time is ripe now for mom and pop stores to also ride the digital wave, and this new partnership with RCBC’s DiskarTech will definitely help us improve the services we offer,” said PASCO President Cristina Constantinoin a virtual launch held earlier in August this year.

For RCBC’s part, on-barding the PASCO members through the DiskarTech app will give the micro-retailers more options to finance and grow their businesses through the different products and services offered in the app.

“DiskarTech’s innovations for MSMEs can definitely help PASCO members to not only weather the challenges brought by the pandemic, but to also sustain and make them more profitable in the future. We hope that DiskarTech can truly become their reliable household and business companion,” said Lito Villanueva, RCBC’s Executive Vice President and Chief Innovation and Inclusion Officer.

DiskarTech’s five-pronged digital finance innovation for mSME inclusion is a holistic, grassroots approach that introduces digital sachet banking to ordinary Filipinos. This innovation for mSMEs includes savings, microinsurance, payments, loans and credit scoring services that can empower micro-retailers and small entrepreneurs, and will help them grow their businesses while promoting inclusive digital finance solutions to consumers.

“Ultimately, our goal is to enable sari-sari stores and other SMEs to become community hubs for financial inclusion and education. We in RCBC believe that micro-retailers and small entrepreneurs are an important backbone of our economy especially during these times. We recognize that small as they are, they truly have tremendous transformative power in helping ordinary Filipinos understand, appreciate and use inclusive digital finance solutions,” says Eugene S. Acevedo, RCBC’s President and Chief Executive Officer.