By Victoria “NIKE” De Dios

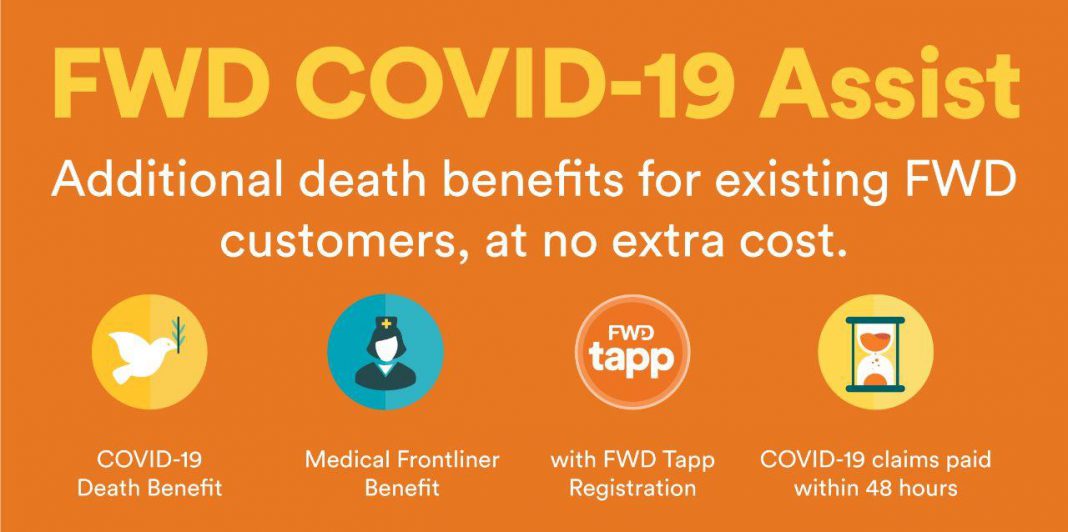

As cases of COVID19 in the Philippines continue to rise, the FWD Life Insurance Philippines recently announced its enhanced COVID-19 coverage for eligible existing customers for their peace of mind. With FWD COVID-19 Assist, all medical and health care workers at the frontline of the fight against the coronavirus will be entitled with lump-sum death benefits for claims from April 16 to May 31, 2020.

“FWD is committed to providing customers with the right support. As such, we constantly review our products to ensure the appropriateness of our benefits and offerings,” said Li Hao Zhuang, FWD Insurance President, and Chief Executive Officer. “

As the COVID-19 pandemic evolves, our Filipino bayanihan spirit is important to us now more than ever, and our enhanced benefit aims to provide extra coverage for medical and health care workers on the frontline whom many consider being our unsung heroes amidst the pandemic.”

FWD COVID-19 Assist provides additional death benefits for:

- Individual plan (except Kandüü, Set Ka Na, and Peace plans): Php 100,000, with additional Php 50,000 if the insured is a medical frontliner

- Kandüü plan: Php 10,000, with additional Php 5,000 if the insured is a medical frontliner

Additional Php 25,000 will be paid if the policyholder is registered with FWD Tapp upon claiming the COVID-19 Assist benefit.

FWD customers with individual policies and Kandüü are eligible for the Php 100,000 benefit. For any FWD COVID-19 offer including the previous COVID-19 Ready and the enhanced COVID-19 Assist, the benefit can only be claimed once.

In addition, FWD Insurance will continue to provide its individual customers additional benefits and consideration in response to the COVID-19 outbreak until May 31, 2020:

- Extension of insurance premium payment grace period to 60 days

- Accepting and processing claims including those filed beyond 30 days

- Accepting insurance claim documents in soft copy format