Lim siblings of Cebu steers family firm’s legacy to new heights at 45

By Monsi A. Serrano

TopLine Business Development Corp. is positioning itself for expansion as it prepares for its initial public offering (IPO), aiming to seize growth opportunities in fuel trading and retail.

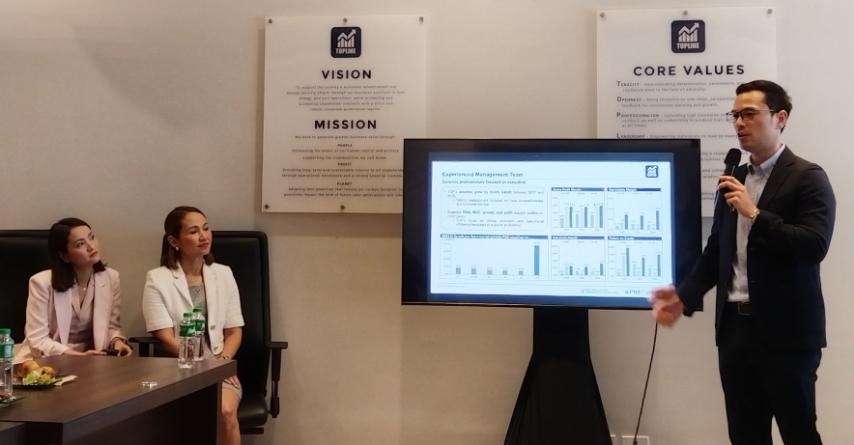

Speaking to the media at its office in Taguig City, TopLine Chairman, President and CEO Eugene Erik Lim revealed that the company expects to raise ₱764.2 million in net proceeds from the sale of up to 2,148,440,000 primary common shares at a target offer price of up to ₱0.38 per share.

Mr. Lim explained that the adjusted allocation of proceeds will fund strategic expansion initiatives, including increasing depot capacity to meet rising fuel demand in both commercial and retail segments, improving importation processes, and expanding operations.

“We have updated our expansion plans based on feedback from potential institutional investors,” he said.

“Our focus is on growing our depot space, enhancing importation processes, and scaling operations. This will strengthen our market position, ensuring a stable fuel supply in the high-growth Central Visayas region while delivering long-term value to our shareholders,” he added.

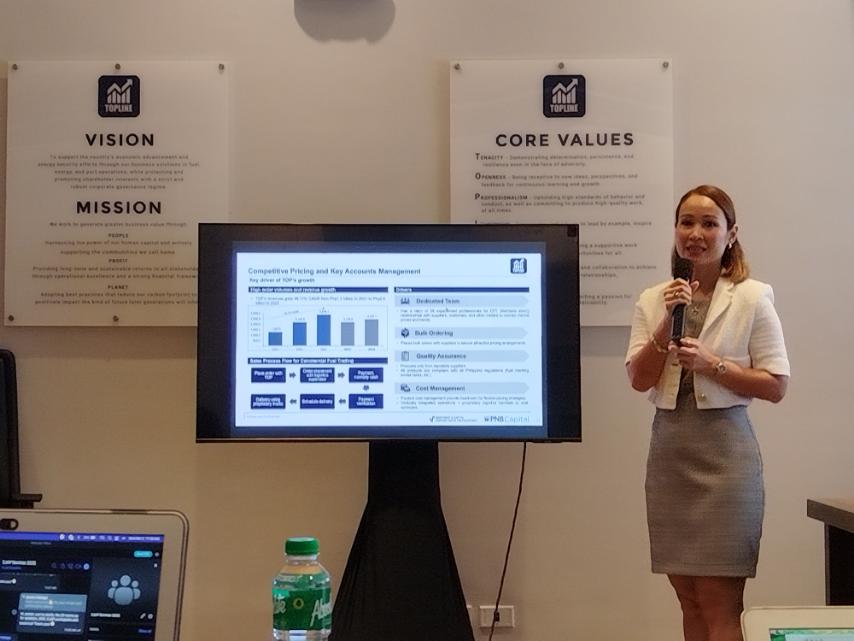

Meanwhile, TopLine Senior Vice President and COO Brigitte Carmel C. Lim stressed the company’s core business: commercial fuel trade and distribution. She outlined how TopLine’s operational strategy is designed to address growing demand, with key customer segments including shipping, “white stations” (independent fuel retailers), transportation, construction, and manufacturing.

She also detailed operational enhancements as the company prepares for its IPO, reinforcing TopLine’s commitment to efficiency and growth.

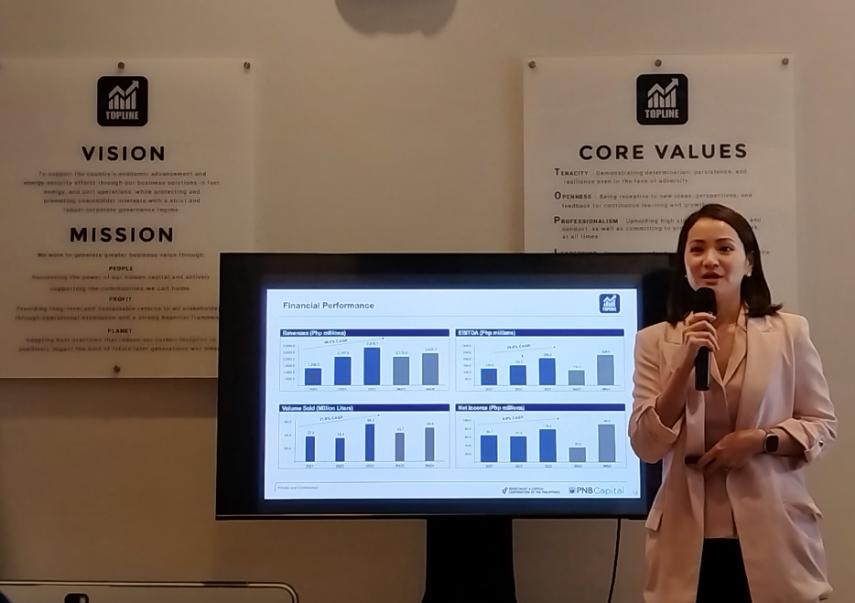

Meanwhile, their sibling Atty. Constance Marie C. Lim, TopLine first vice president and CFO, spoke confidently of their company’s steady financial growth.

She noted how since 2021, TopLine’s revenues have climbed significantly: ₱1.2 billion in 2021, ₱2.1 billion in 2022, and ₱2.8 billion in 2023.

“In the third quarter of 2024 alone, TopLine posted ₱2.4 billion in revenue, reflecting a 12% year-on-year growth,” Atty. Lim said. “We also recorded a 19% increase in fuel volume sold, reaching 5.4 million liters in the first nine months of the year.”

TopLine’s EBITDA also surged 102% in the third quarter of 2024 compared with the same period in 2023, closing at ₱229 million. Net income grew by 157% year-on-year over the same timeline.

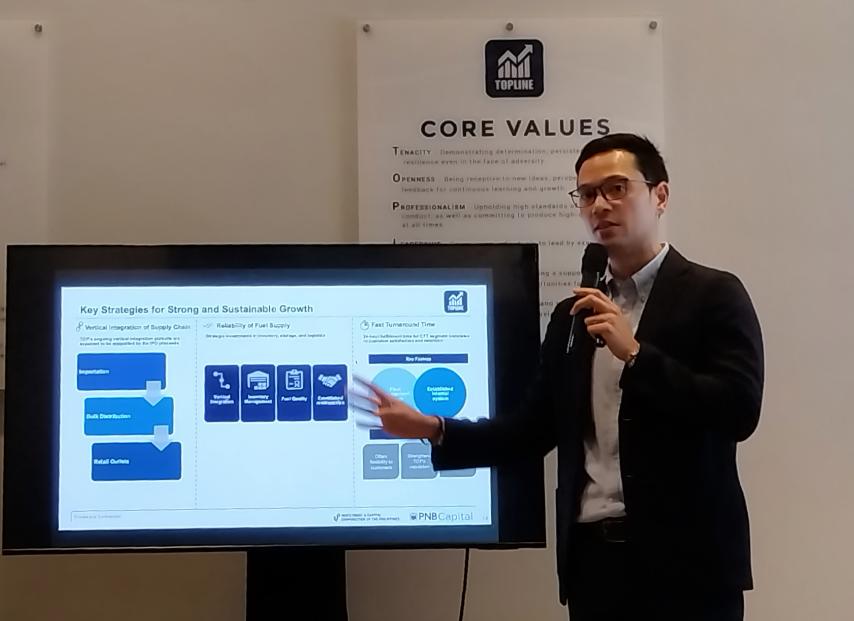

Strategic Action Plans

TopLine will use part of its net proceeds to build 20 new Light Fuels stations, set to open by 2025-2026. Targeting underserved areas, the brand will roll out Express stations designed for quick motorcycle refueling. These will feature fast-service perks like motorcycle and helmet wash areas and RFID-enabled lanes for seamless transactions.

At present, Light Fuels operates four stations, while six more are under various stages of development. By the first quarter of 2025, the company aims to have 10 operational stations, including three Express locations, subject to market conditions and project timelines.

Looking ahead, TopLine targets an expanded network of 30 operational Light Fuels stations by 2026, with 20 of them funded by IPO proceeds.

Expanding Fuel Storage Capabilities

To enhance fuel storage and ensure supply stability, TopLine plans to acquire a five-million-liter fuel tanker.

A portion of the net proceeds will also go toward working capital, covering fuel stock sourced from local and international suppliers. The remainder will be used for general corporate purposes.

Meanwhile, the construction of additional depot facilities, initially outlined in the company’s prospectus last year, will be funded from external sources beyond the IPO.

“By integrating our supply chain, we’re mitigating risks, improving profit margins, and ensuring stable product quality,” Lim noted. “This operational efficiency will sustain our momentum as we continue to scale.”

IPO Timing and Market Outlook

When asked about the decision to proceed with an IPO despite global market volatility and trade tensions, Lim was unfazed.

“There’s no perfect situation — only a perfect mindset,” he said.

On the sidelines, he told THEPHILBIZNEWS that TopLine remains confident in its public offering.

“We have big plans beyond Cebu, and now is the best time to expand, given the strong economic indicators,” he said. “Investor confidence is high, and foreign policy remains inclusive, fostering trade and investment growth.”

He also pointed out the optimism among TopLine’s strategic foreign partners.

“They see our clear roadmap. We present the data, the market demand, and our overarching strategy — and it resonates with them,” Lim said. “This is the legacy we want to continue as the third generation running this business. We appreciate the media for being enablers of investment in the Philippines. Daghang salamat!”

TopLine operates across multiple sectors, including fuel, retail, real estate, ports, energy, and tech. With 45 years of business experience in Cebu, the company is now set to expand beyond the Central Visayas region.

TopLine’s target listing date is April 8, 2025, subject to approval from the Philippine Stock Exchange (PSE) and the issuance of a Permit to Sell by the Securities and Exchange Commission (SEC).